Risk-Adjusted DCA for Crypto

Discover Stress-Free investing and improve your returns with Risk-Adjusted DCA.

You can't predict the market.

Neither can we.

But we can make sense of the present. That's how we're taking DCA to the next level.

Stress-free investing

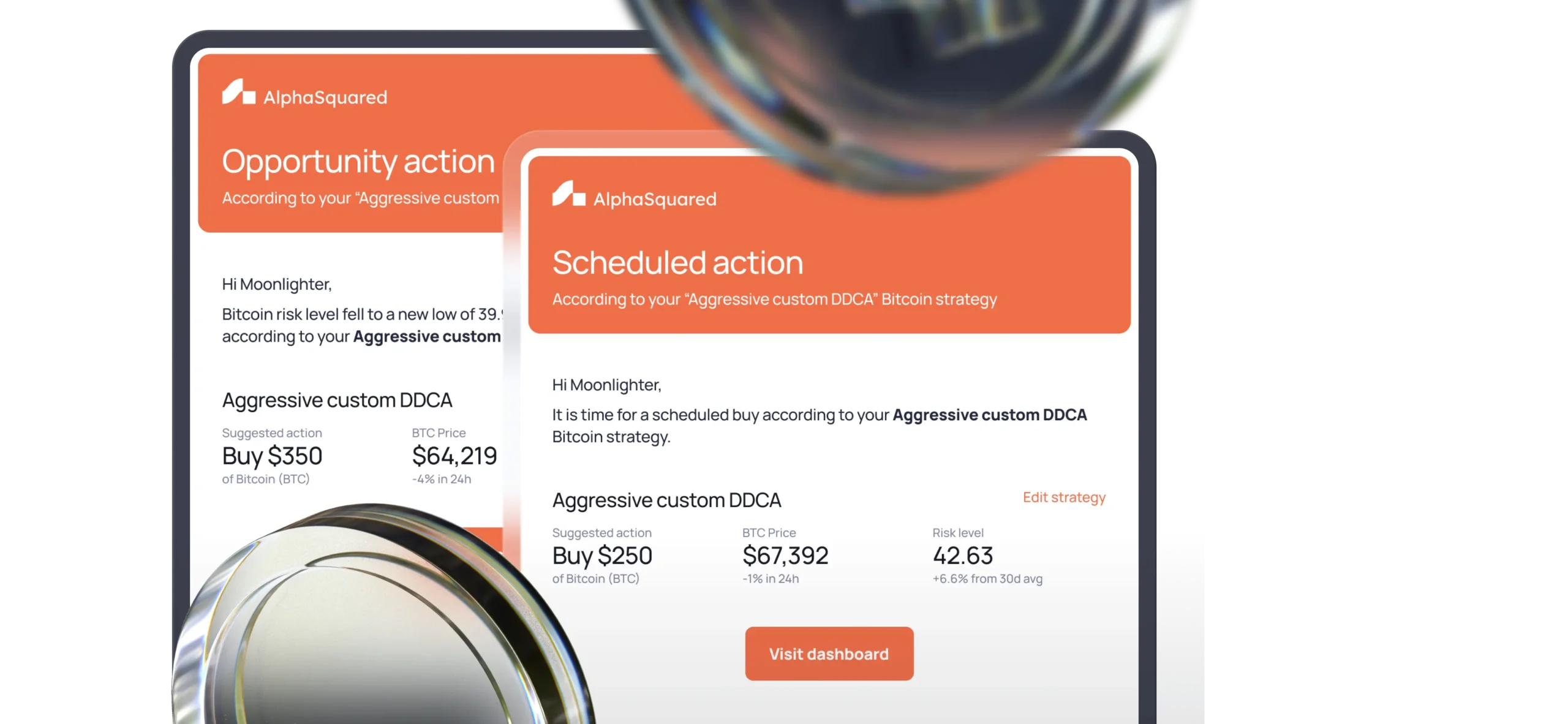

Stay objective and make confident decisions when it matters the most by sticking to your personal Risk Strategy.

BTC drops... check the risk metric... all good, and the decision to buy or not is made. Feels good!

"I love having this tool to help make decisions and cut out FOMO and FUD."

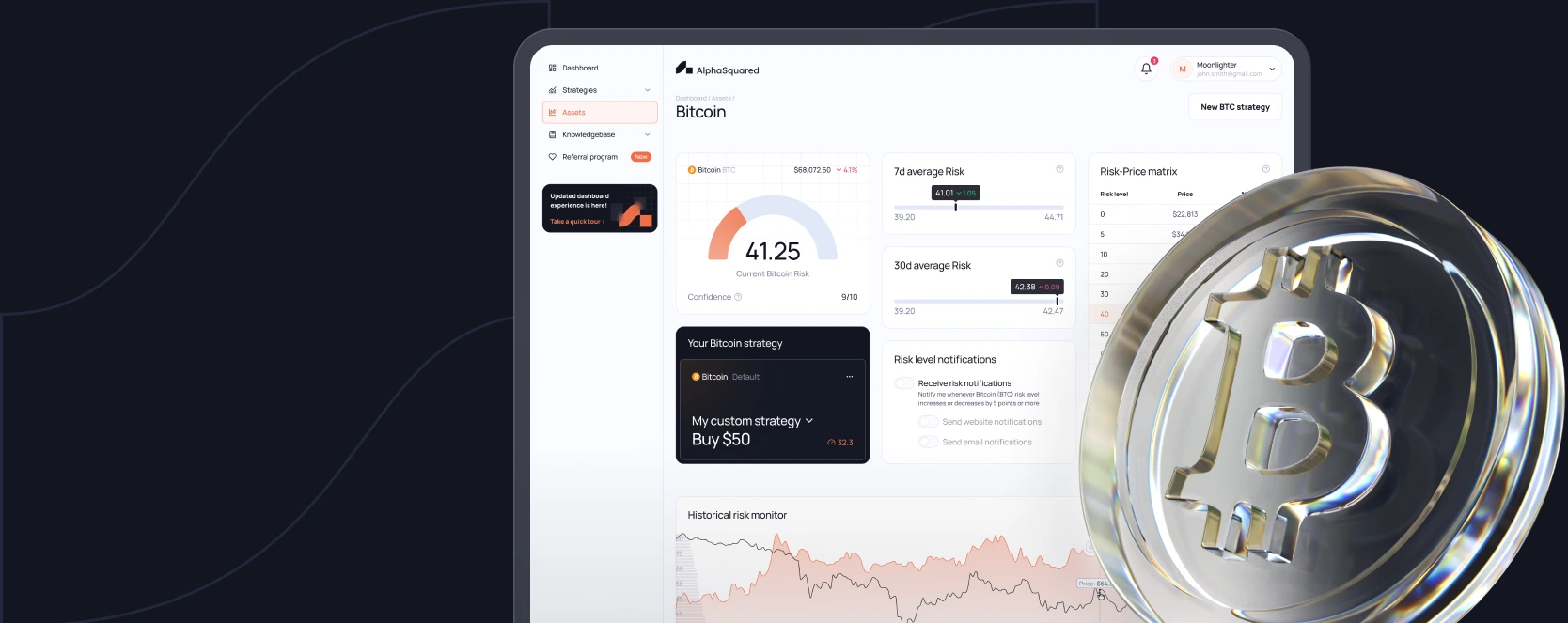

What is risk?

A score between 0 and 100 representing the market’s pulse.

Computed by machine learning, our Risk Model distills vast

market data into an easy-to-understand score for Bitcoin and other assets.

Note! We do not retrofit any data. BTC Risk levels calculated daily since 2021 remain unaltered historically.

How does it work?

1. Assess risk levels

Sign up to view live risk levels for the most popular assets on the market

Sign up for free2. Pick strategy

Pick a predefined investment strategy or set up your own custom one

3. Set it and forget it

Follow your strategy and enjoy higher gains without any doubt or uncertainty!

Key benefits of AlphaSquared

Clarity

Effortless and objective - Let our Risk Model do all the heavy lifting

Performance

The risk-adjusted DCA strategy is proven to outperform regular DCA since 2021

Confidence

Should I take profits? Stay confident with Risk-adjusted DCA and Risk-alerts

Worry less.

Accumulate more.

Test how Risk-based DCA drastically improves your returns and BTC accumulation.

|

Strategy

An aggressive strategy invests up to higher risk, while conservative does the opposite.

|

Investment

Total strategy investment. Low risk generally means frequent investments; high risk pauses investments.

|

Balance

Your final wealth measured in both the asset and in USD. The price of the asset at 'End date' may greatly affect this value.

|

Profit

The profit of the strategy in percentage and in dollars.

|

Reward/Risk

Profit earned per unit of risk taken. High values indicate strategies that maximize profits efficiently while minimizing risk. Formula: Total profit / Total risk exposure.

|

|---|---|---|---|---|

| Risk-Adjusted DCA | - |

-

-

|

-

-

|

- |

| Regular DCA | - |

-

-

|

-

-

|

- |

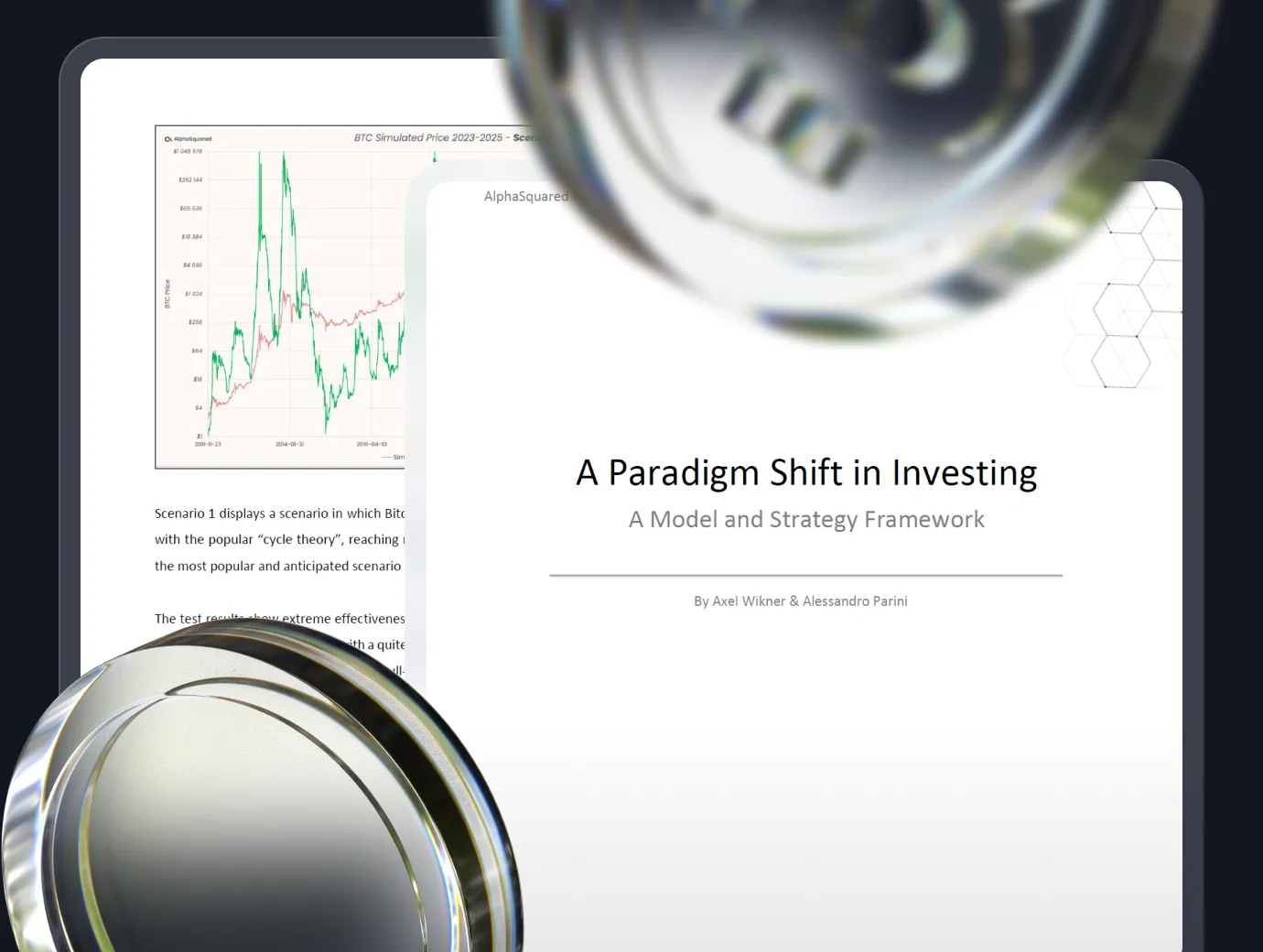

The minds behind

Initially, the Risk Model was in our private toolbox. What began as an experiment in exploiting risk identification, rather than predicting prices, yielded impressive results.

Seeing the potential for a much wider application in finance than we initially anticipated, we felt compelled to share it with the world.

Alessandro Parini

Economist

University of Basel

Co-founder

Axel Wikner

BA & Data Scientist

NTNU

Co-founder

The Risk Model

Real-time calculation & notifications

Analyzed and trained on price,

sentiment, volatility, on chain, macroeconomics,

black swan events, and more

Stress-tested of hundreds on potential market

scenarios using simulations

Proven track record since 2021

Get started for free

Try for free"The BTC Risk Metric alone has easily paid for the lifetime membership 100 times over."

Free trial

Free trial includes

Access to BTC, ETH, SOL and many more.

Get notified of risk level changes

Test with historic data

Access live risk levels

No credit card or personal info required

Monthly plan

Most popularYearly plan

17% total savingsPlan includes

Access to BTC, ETH, SOL and many more.

Get notified of risk level changes

Test with historic data

Access live risk levels

Lifetime Plan

Lifetime plan includes

Access to BTC, ETH, SOL and many more.

Get notified of risk level changes

Test with historic data

Access live risk levels

Single payment, lifetime benefits.

Still in doubt?

Everything you need to know about the product and billing. Can’t find the answer you’re looking for? Feel free to chat with us.

Multifactorial Design & Input Variables

The Risk Model is multifactorial, meaning it considers a vast amount of market factors and data points to compute the risk. Some key attributes include asset growth models for capturing asset-specific patterns, regression to model time and seasonality, and traditional TA metrics for price-based classification.

Self-Adjusting Mechanism

The model is self-adjusting, updating and refining itself daily as new data becomes available. This continuous improvement enhances its accuracy and confidence level over time. The algorithm is powered by a range of techniques including data analysis, statistical modeling, and automation.

Historical vs. Live Data

It’s crucial to understand that while the algorithm improves daily, the historical risk levels reflect the data shown on our live risk meter for each specific day. The model is not retrofitted or predictive; it classifies the current price on a daily basis.

Naturally, the exact mathematical components of our model remain proprietary. However, you can dive a lot deeper into its build, input variables, and other attributes in our whitepaper.

Our Bitcoin model has been live since mid-2021 and has consistently shown very convincing results since. The historical data you see is not backfitted; it is the actual risk calculated on that day. You can use our strategy builder to backtest based on this real data to see performance.

In addition to real-world performance, all our models go through a 3-step framework. It involves dataset optimization, backtesting and benchmarking against other strategies, and finally forward-and stress-testing.

AlphaSquared is the only platform in the crypto space currently offering forward-testing capabilities using simulations. You can try these in the strategy builder.

No. The model does not predict what will happen in the future, as history has proven that predicting market movements is not productive. Instead, the uniqueness of it lies in its ability to tell you what is happening right now.

The model computes the current market risk with high precision. This means that whenever the market is overheated or oversold, the model will inform you. It cannot tell when in time that will occur. Being a macro model, this gives you more than enough time to either calmly DCA out of the market and take profits, or reduce your investments. This same principle also applies to major bottoms.

In short, you invest more when the risk is low, and less when the risk is high, or take profits if you wish. This earns you more BTC per dollar invested and reduces your risk. Watch tutorials in our knowledgebase.

You can follow pre-constructed strategies available in the member dashboard, or create your own strategy which is suited to your personal risk tolerance and goals.

Since the model is built for long-term gains and not for speculative trading, there’s no conflict of interest in sharing it.

Risk-Adjusted DCA is not a get-rich-quick scheme, nor is the risk model a magic buy/sell indicator that guarantees instant wealth. Instead the model helps disciplined investors with realistic time horizons improve long-term gains while reducing the emotional stress of investing.

We believe in helping other investors benefit from the same disciplined, realistic approach we've used ourselves for years.

We currently provide risk metrics for the following crypto assets:

- Bitcoin

- Ethereum

- Solana

- Cardano

- S&P 500

- Chainlink

- Polkadot

- Binance

More are being added according to our Member's votes on Telegram.

14-day free trial with no credit card, no strings attached.

Try for freeJoin our thriving

Telegram community.

Gain access to our Telegram channel, where you can connect with like-minded crypto enthusiasts, share insights, and get early access to new features and updates.

Join now