Knowledgebase

Watch tutorials and learn more about our models

Watch our video tutorials or read on below

Learn More About our Risk Models

Dynamic DCA

Dollar Cost Averaging (DCA) is a fixed, regular investment method that reduces portfolio volatility risks but can limit profits and capital effiency.

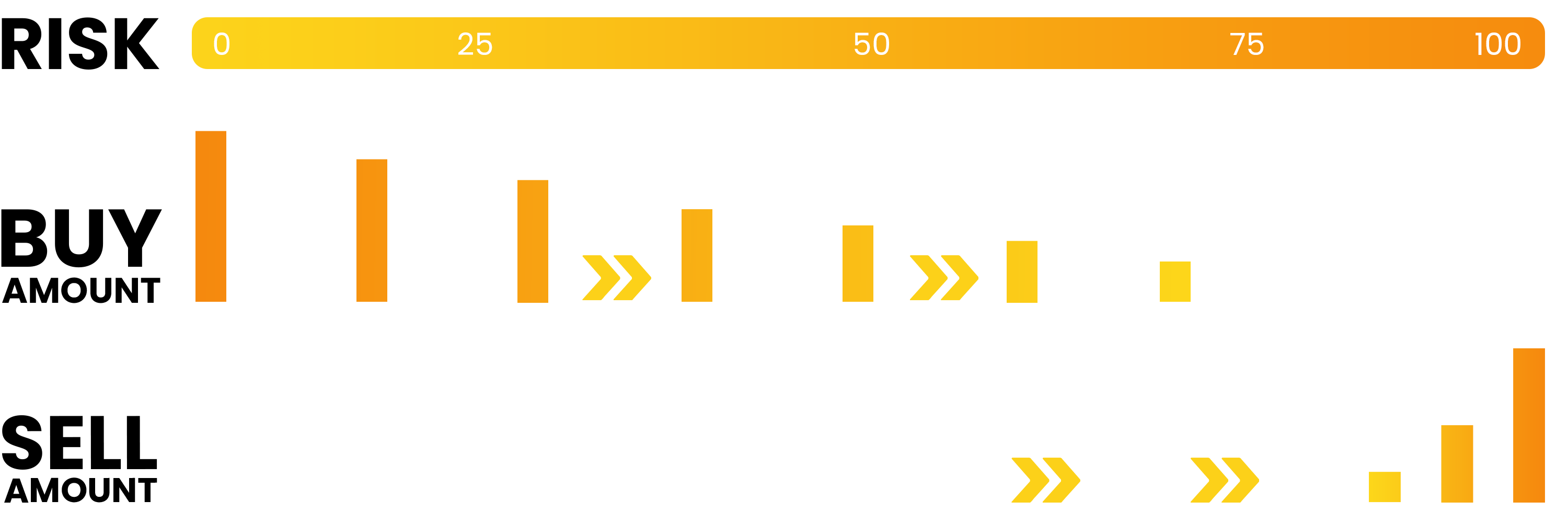

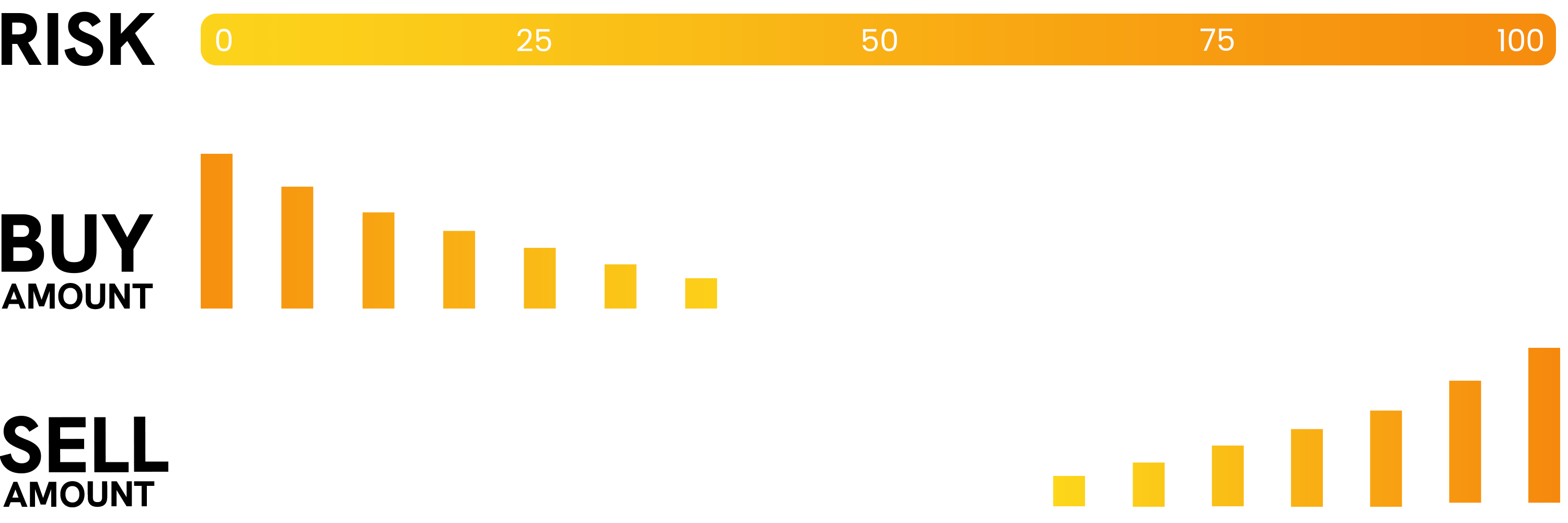

In contrast, Dynamic DCA is a more responsive strategy which involves adjusting the amount you buy or sell according to the risk of the asset. Put simply, the lower the risk, the more you buy, the higher the risk, the more you sell.

Dynamic DCA

Dynamic DCA has anumber of advantages

- Lower average purchase cost

- Allows to confidently take profits during bullmarkets

- Eliminates DCA-Anxiety & emotional investing

- Allows for more personalized strategy-building

Ready-to-use strategies

A strategy will make you consistent as an investor and help you avoid impulsive decisions. You can choose to have a conservative Dynamic DCA strategy, an aggressive Dynamic DCA strategy, or something in between.

Pick a ready-to-use strategy that fits your risk-profile, or combine different strategies into your own.

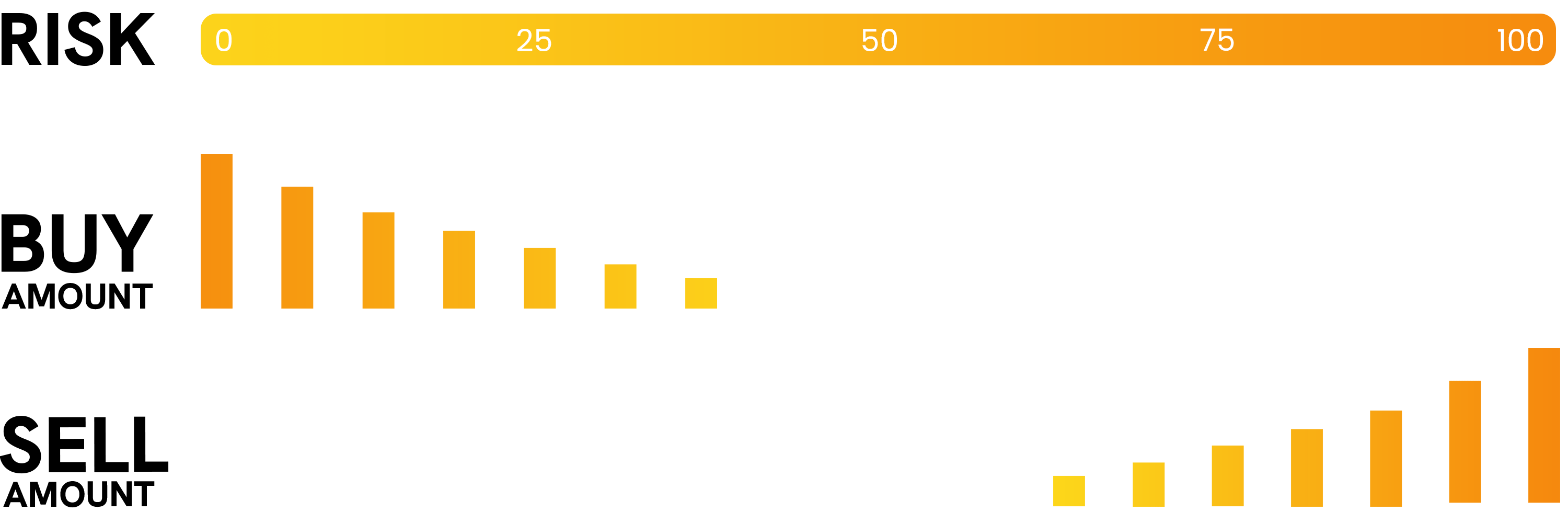

A conservative strategy means to wait for lower risk levels before you begin to buy. This approach minimizes the potential for significant portfolio drawdowns and ensures a better average purchase price. Additionally, selling begins at relatively lower risk levels, allowing for early profit realization and reducing the chance of missed profit opportunities.

Typical Buy Range: 0 – 20 Risk

Typical Sell Range: 40 – 80 Risk

+ Advantages

- Minimized overall risk exposure

- Frequent and early profit realization

- Lowered potential for significant portfolio drawdowns

– Limitations

- Potentially reduced profit margins

- Possibility of missing extended rallies

- Potential long waiting periods before making a purchase

Ideal for investors who

- Aim for steady portfolio growth with minimized risk

- Prioritize wealth preservation

- Seek to avoid significant portfolio drawdowns

- May require quick portfolio liquidation

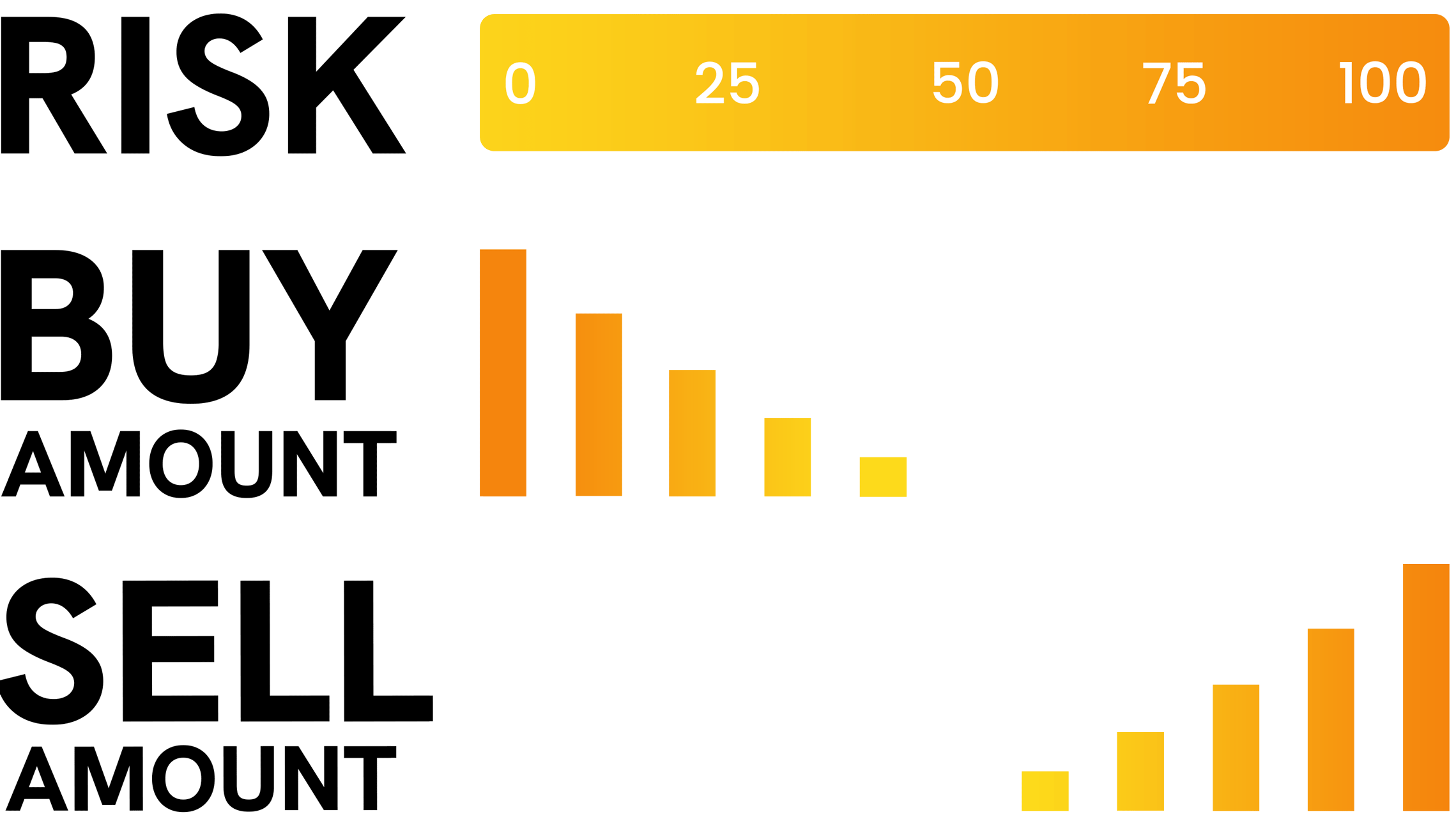

A moderate strategy involves buying when the risk is below 50 and selling when it’s above 50. This ensures you gain exposure to the asset without waiting for extreme risk levels. It also guarantees profit realization without holding out for the highest risk scenarios. Yet, this approach doesn’t exclude the potential of capitalizing on moments when the risk reaches either 0 or 100.

Suggested Buy Range: 0 – 50 Risk (Consider a buffer zone between 45 – 55 Risk to prevent excessive transactions)

Suggested Sell Range: 50 – 100 Risk

+ Advantages

- Balanced risk exposure

- Broad window for both buying and selling

- Opportunity to engage at both very low and very high risk levels

– Limitations

- Potential for significant short-term portfolio drawdowns

Ideal for investors who

- Seek portfolio growth and can tolerate moderate risk

- Have a medium to long-term investment horizon

- Don’t anticipate major expenditures in the immediate future.

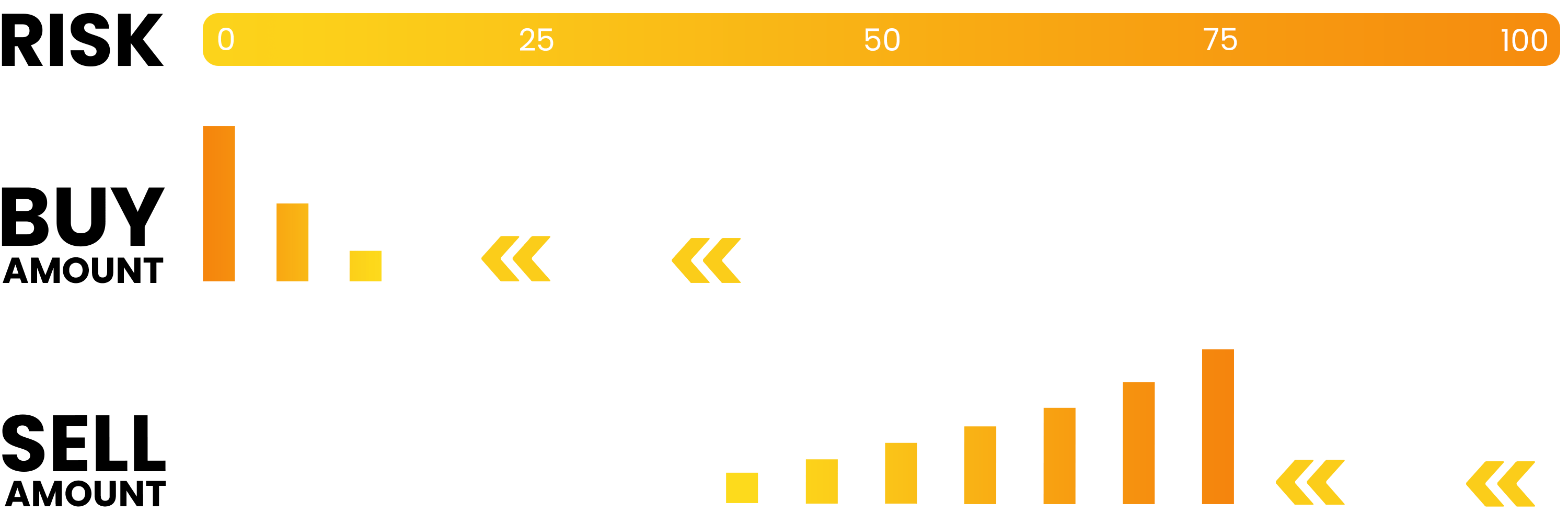

An aggressive strategy involves buying up to higher risk levels while still selling only at the very high-end risk. This approach aims to quickly engage in the market, getting substantial skin in the game, but reserves selling for only when the risk is high to maximize returns.

Example Buy Range: 0 – 70 Risk

Example Sell Range: 80 – 100 Risk

+ Advantages

- Potential for maximized returns

- Quick market entry, ensuring significant investment participation

– Cons

- Increased risk of substantial drawdowns over extended periods

- Potential to miss out on selling if risk doesn’t hit extremes

Ideal for investors who

- Are at ease with high-risk scenarios

- Can stomach substantial portfolio fluctuations

- Have a long-term investment perspective

- Are focused on wealth accumulation.

AlphaSquared is not a financial advisor. Do not take anything on alphasquared.io as financial advice, ever. Do your own research. Consult a professional investment advisor before making any investment decisions.