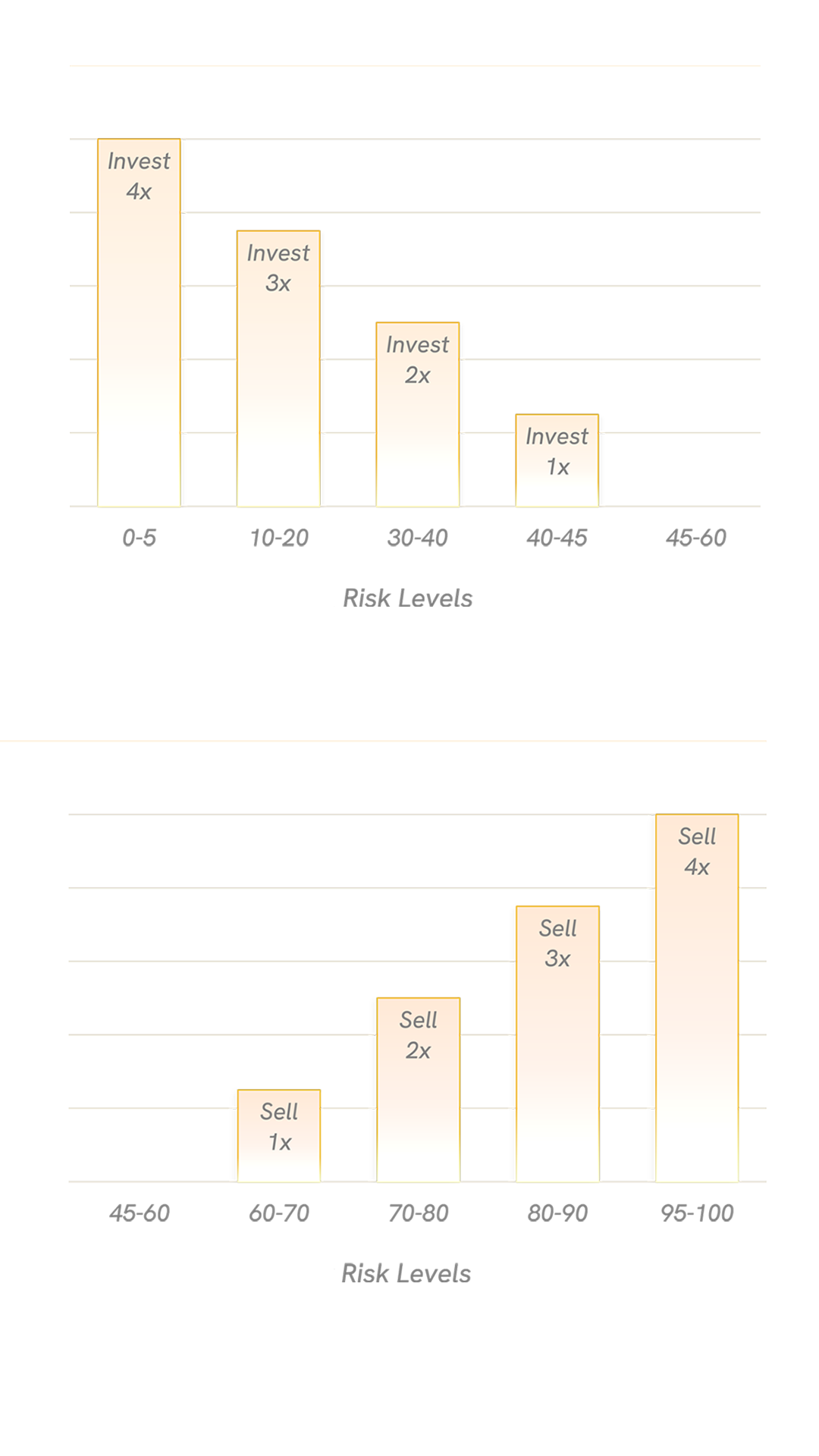

Dollar Cost Averaging (DCA) is a fixed, regular investment method that reduces portfolio volatility risks but can limit profits and capital effiency.

In contrast, Dynamic DCA is a more responsive strategy which involves adjusting the amount you buy or sell according to the risk of the asset. Put simply, the lower the risk, the more you buy, the higher the risk, the more you sell.

DDCA, used in conjuction with our model, has several benefits:

- It optimizes your average purchase price, minimizing potential time spent in a loss.

- You avoid buying into hype, and selling into fear.

- You take profits, even if the asset never reaches a new all time high.

- It is fully customizable to your personal risk tolerance.

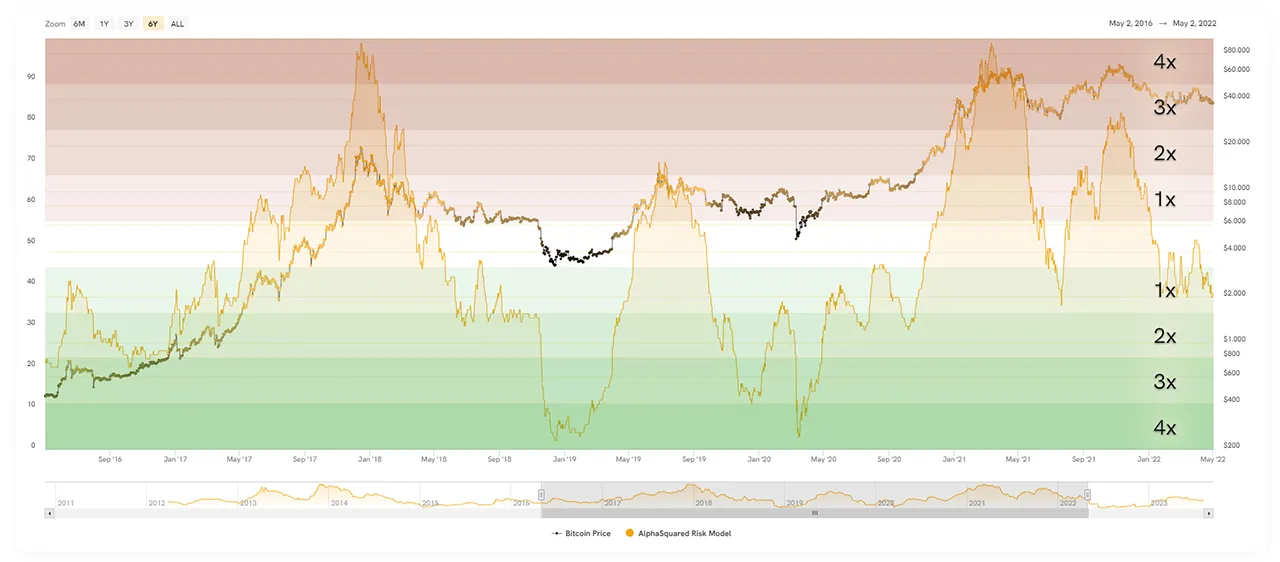

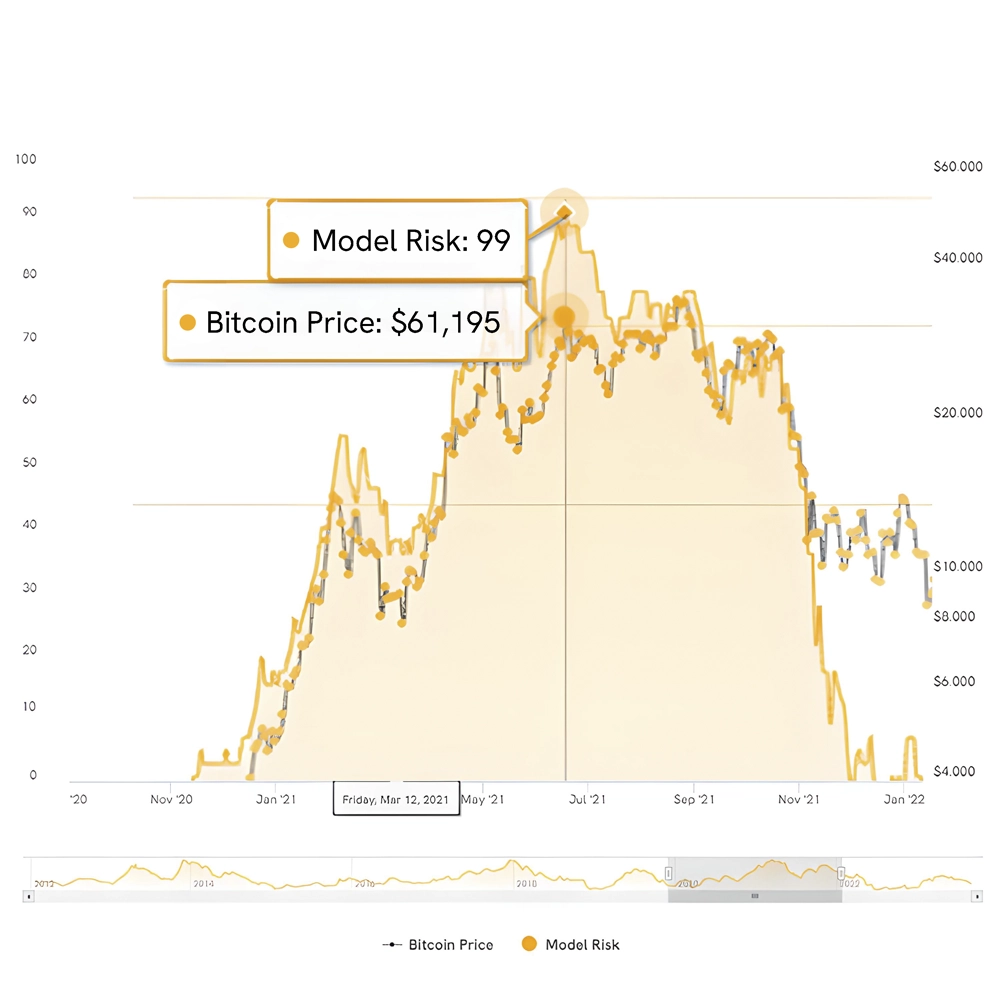

With our risk model, you’re not predicting the future – you’re understanding the present.

The model condenses complex data into a single, actionable metric, helping you take the guesswork out of investing. This allows you to focus on and react to the present state of the market, rather than getting caught up in the noise of predictions and hype.

Our model takes a variety of factors as input and applies quantitative tools to calculate a risk level between 0-100. The underlying algorithm is self-learning and improves itself daily as new data becomes available. The algorithm is built using data-analysis, statistics, and automation.

The factors taken into consideration are handpicked and based upon a strong domain knowledge in finance and bitcoin expertise.

Some key attributes in the model include:

- Asset growth models for capturing asset-specific patterns

- Traditional technical analysis for price-based classification

- Regression for modeling time and seasonality

- Machine learning for dynamically determining variable weight

Discover how our custom testing framework (PoP) goes beyond traditional methods, ensuring the reliability of the the model.

Optimization

Upgrade your DCA strategy with Risk today.

Historical Risk Monitor

No credit card required

Lifetime Access

Identify pristine opportunities, maximize your long-term BTC stack and leave complexity behind.

Our whitepaper covers:

- The technical and fundamental underpinnings of the model

- Detailed backtesting results, benchmarked against other popular strategies

- In-depth process of constructing realistic price simulations

- Forward-testing and stress-testing results using simulations

- Our journey so far and our vision for the future