You’ve decided to invest in Bitcoin. But, you’re torn between going all-in with a lump sum or using dollar cost averaging (DCA). After all, you don’t want to make a mistake that could jeopardize your capital or limit your potential returns.

We have decided to put both strategies to the test – with a twist. We will not only evaluate absolute returns of each Strategy, but also calculate Risk-adjusted Returns using our Risk Model.

You can even do your own testing using our Lump Sum vs DCA Calculator. We encourage you to read on to see our testing results.

But, before we dive into the juicy numbers and performance data, it’s crucial to understand that the “best” strategy goes beyond just returns.

From experience, we know the key to a successful investing strategy. It does not revolve around the returns you see in testing, but rather other crucial factors. We’ve distilled these into 4 key questions you should ask yourself before picking lump sum, DCA, or any other Bitcoin investment strategy.

These often overlooked elements can make or break your portfolio, so let’s tackle them first.

Part 1: Beyond Just Returns

Managing Emotional Volatility: Can you Tolerate the Risk?

![]()

One of the biggest hurdles in Bitcoin investing is managing the emotional rollercoaster. Investing a lump sum makes this challenge worse. The market’s ups and downs exposes your entire capital right from the get go.

Watching a large sum fluctuate wildly can be very tough psychologically. It often leads to anxiety, rash decisions, and even panic selling at the worst times.

Dollar cost averaging, on the other hand, can help reduce some of this emotional burden. By investing small amounts over time, you reduce the impact of volatility on your portfolio. This makes it easier to stay the course and avoid rash decisions driven by fear or greed.

Ask yourself: How well can you handle the stress of watching your entire investment rise and fall each day?

Short-Term vs. Long-Term: Does Your Time Horizon Matter?

Your investment time horizon is another crucial factor.

For short-term investors looking for quick gains, lump sum investing may be better. But, this is only true if you believe you can predict the market. Research shows this is nearly impossible for retail investors like you and me. We learned the hard way. That’s what led us to build risk models that classify the present instead. This worked so well it’s what eventually turned into AlphaSquared!

For long-term investors unsure where markets might head next, DCA is usually a better approach. Spreading out your investment over time averages out your buy-in price, which reduces the risk of entering at a market peak.

This long-term perspective also allows you to ride out the inevitable volatility and market cycles.

Ask yourself: Are you investing for the short-term or long-haul? And do you truly have the skills to predict the market effectively?

Bull or Bear?: Timing Your Bitcoin Investment Strategy

When do you think most people buy their first crypto? That’s right, at a time that they shouldn’t have. 99% of retail investors tend to enter the crypto market during bull runs, when prices are already high. In such cases, lump sum investing can be a devastating strategy, as you risk buying near the top of the market.

During periods of heightened uncertainty, however, DCA can shine. By investing small amounts often, you can slowly accumulate Bitcoin at lower prices. This may set you up for better long-term returns when the market recovers.

Of course, if you can invest a lump sum into bitcoin at the end of a bear market, you will experience much better returns than with DCA. If you’re wondering about where the market might head in the future, we have no clue. But if you’re wondering where the market is right now: Our risk model will help you. You can sign up for free here.

Ask yourself: Are you entering the market during a bull run or bear market?

Building Investment Discipline: Can you Stick to your Plan?

DCA also has another advantage. It can teach good investing habits and discipline. By regularly investing a fixed amount, you develop a routine. This can serve you very well, especially when the market becomes overbought or frothy.

If you think you’d struggle with discipline, consider trying AlphaSquared’s risk-based DCA notifications. These will keep you disciplined by letting you know how much to invest and when based on your personal DCA strategy. This removes all the headache and hesitation from investing.

Conversely, lump sum investing is an “all or nothing” strategy. 100% exposure from the start can tempt you to stray from your strategy or make rash decisions based on short-term market moves. While mistakes with DCA can be costly, mistakes with lump sum investing can wipe out your entire capital.

Ask yourself: Do you have the ice in your veins required to see all your capital plummet by 30% the day after you enter a lump sum position?

Summary of Pros and Cons: Lump Sum vs DCA

To summarize the key pros and cons discussed:

Lump Sum Investing Pros:

- Potential for higher returns by being fully invested from the start

- Simplicity of execution

Lump Sum Investing Cons:

- Higher volatility and emotional burden

- Risky if entering at a market high

DCA (Regular) Pros:

- Reduces impact of volatility and risk

- Easier emotionally/psychologically

DCA (Regular) Cons:

- Potential for lower overall returns

- Opportunity cost of not being fully invested

As you can see, both strategies have their merits and drawbacks. It may seem like DCA often gets the upper-hand in these qualitative measures. But what about their actual performance and returns over time? That’s what we’ll explore in Part 2.

Part 2: Performance Comparison

Lump Sum vs DCA: Put to the Test

Let’s talk about actual results. We put these two approaches to the test ourselves by writing some code. We ran a historical backtest that simulates executing lump sum and DCA strategies over different time periods in the Bitcoin market.

This allowed us to track and compare key metrics like profits, Bitcoin held, and even calculate a reward-risk ratio using AlphaSquared’s daily Bitcoin risk model data.

Let’s quickly go over the specifics of how we constructed and ran this backtest:

Backtesting Methodology

- We used historical Bitcoin price data up until March 19th 2024

- For lump sum, we invested $1,000 upfront on the start date

- For DCA, we invested $25 monthly until hitting that $1,000 total investment

- We calculate %-profit, $-profit, Bitcoin accumulated, and most importantly reward-per-risk ratio

Click to see the code

# Our backtesting function.

def calculate_investment_returns(start_date, end_date, lump_sum_amount, dca_amount, dca_frequency):

# Load historical Bitcoin price data

btc_data = pd.read_csv('/content/drive/My Drive/Colab Notebooks/Data & Files/Price Data/BTC_Historical_Processed_X.csv')

# Ensure data is sorted by date for accurate processing

btc_data.sort_values(by='Date', inplace=True)

# Helper function to convert string dates to datetime objects for easy comparison

def parse_date(date_str):

return datetime.strptime(date_str, '%Y-%m-%d')

# Selects only the rows within the specified start and end dates

filtered_data = btc_data[(btc_data['Date'] >= start_date) & (btc_data['Date'] <= end_date)].copy()

filtered_data['Date'] = filtered_data['Date'].apply(parse_date)

filtered_data.sort_values(by='Date', inplace=True)

# Prepares the dataset for recording buy actions

btc_data['lump_sum_buy'] = np.nan # Track lump sum buy price

btc_data['dca_buy'] = np.nan # Track DCA buy prices

# Lump sum investment calculation

initial_btc = lump_sum_amount / filtered_data.iloc[0]['Price']

final_value_lump_sum = initial_btc * filtered_data.iloc[-1]['Price']

profit_lump_sum = final_value_lump_sum - lump_sum_amount

lump_sum_risk_reward_sum = (initial_btc * filtered_data['Risk']).sum()

lump_sum_risk_reward = profit_lump_sum / lump_sum_risk_reward_sum

# Update the lump_sum_buy column in btc_data for the row that matches the start_date

btc_data.loc[btc_data['Date'] == start_date, 'lump_sum_buy'] = filtered_data.iloc[0]['Price']

# Sets up our DCA investment strategy by defining investment dates based on frequency

dca_dates = pd.date_range(start=filtered_data.iloc[0]['Date'], end=filtered_data.iloc[-1]['Date'], freq=dca_frequency)

dca_investment_total = 0

btc_held = 0

dca_risk_reward_sum = 0

# Ensure 'Date' columns in both DataFrames are datetime objects

btc_data['Date'] = pd.to_datetime(btc_data['Date'], format='%Y-%m-%d')

filtered_data['Date'] = pd.to_datetime(filtered_data['Date'], format='%Y-%m-%d')

# Iterates over each date in the filtered dataset to simulate DCA purchases

for date in filtered_data['Date']:

if date in dca_dates and dca_investment_total < lump_sum_amount:

price_on_dca_date = filtered_data[filtered_data['Date'] == date]['Price'].iloc[0]

btc_held += dca_amount / price_on_dca_date

dca_investment_total += dca_amount

# Records the DCA buy for later analysis or visualization

btc_data.loc[btc_data['Date'] == date, 'dca_buy'] = price_on_dca_date

risk_on_date = filtered_data[filtered_data['Date'] == date]['Risk'].iloc[0]

dca_risk_reward_sum += btc_held * risk_on_date

# Calculates the final value and profit for the DCA strategy

final_value_dca = btc_held * filtered_data.iloc[-1]['Price']

profit_dca = final_value_dca - dca_investment_total

dca_risk_reward = profit_dca / dca_risk_reward_sum if dca_risk_reward_sum else 0

# Checks if the DCA strategy was able to invest an equivalent amount to the lump sum

dca_message = ""

if dca_investment_total < lump_sum_amount:

dca_message = "The total DCA amount invested did not reach the lump sum amount before the period ended."

# Returns detailed results for both investment strategies, including profits, BTC held, and risk-reward ratios

return btc_data, {

'Lump Sum': {

'% Profit': round((profit_lump_sum / lump_sum_amount) * 100,0),

'$ Profit': round(profit_lump_sum,0),

'BTC on Hand': round(initial_btc,5),

'Reward per Risk Ratio': round(lump_sum_risk_reward,2),

},

'DCA': {

'% Profit': round((profit_dca / dca_investment_total) * 100,0),

'$ Profit': round(profit_dca,0),

'BTC on Hand': round(btc_held,5),

'Reward per Risk Ratio': round(dca_risk_reward,2),

'Message': dca_message,

},

'Period': f"From {start_date} to {end_date}",

'Final_BTC_Price': round(filtered_data.iloc[-1]['Price'],0)

}

"""

Bitcoin Investment Returns Calculator

This script calculates and compares the returns of investing in Bitcoin (BTC) via a lump sum amount versus a Dollar-Cost Averaging (DCA) strategy over a specified date range. It utilizes historical BTC price data to perform the comparison.

Author: Axel Wikner

Date: Mar 17th 2025

Version: 1.0

Requirements: pandas, numpy, datetime

Usage: This script is designed to be imported as a module and expects the user to call `calculate_investment_returns` with appropriate parameters.

"""

Bitcoin Lump Sum vs DCA Backtest

With the backtest setup, it’s time to run the numbers over different periods to see how lump sum and DCA truly compare. We chose two separate test periods that capture different market conditions and cycles:

Test 1: Investing During a Bitcoin Bull Market

Start Date: Jan 1st 2018, End Date: March 19th 2024

| Profit (%) | Profit ($) | BTC on Hand | Reward per Risk | |

|---|---|---|---|---|

| DCA | 668% | $6,676 | 0.12384 | 0.76 |

| Lump Sum | 361% | $3,610 | 0.07438 | 0.53 |

Test 2: Investing During a Bitcoin Bear Market

Let’s fast-forward one year and see what happens if we would have invested 12 months later.

Start Date: Jan 1st 2019, End Date: March 19th 2024

| Profit (%) | Profit ($) | BTC on Hand | Reward-per-Risk | |

|---|---|---|---|---|

| Lump Sum | 1527% | $15,273 | 0.26254 | 0.77 |

| DCA | 427% | $4,207 | 0.08502 | 0.80 |

As you can see, the results differ significantly between these two periods. But why? And what does it really tell us about which strategy is “better”? Let’s unpack what all this really means.

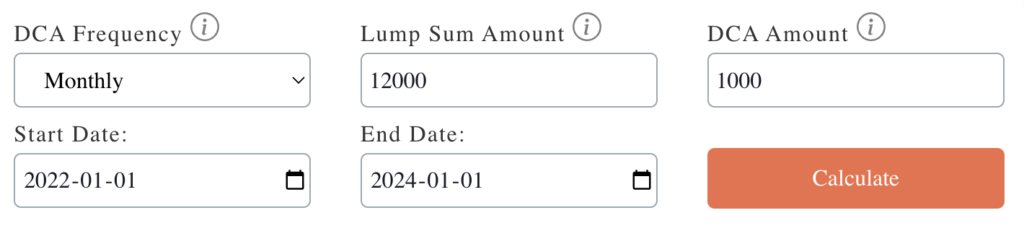

If you’re eager to test this yourself, you can use this calculator:

Testing Strategy

Testing Strategy

Bitcoin Lump Sum vs DCA Calculator

| Profit (%) | Profit ($) | Reward per Risk | BTC on Hand | |

|---|---|---|---|---|

| Lump Sum | - | - | - | - |

| DCA | - | - | - | - |

Interpreting the Results

Returns: Timing is Everything

The backtest results showed one key point. Timing your investment entry relative to market cycles can make or break your returns, especially with a lump sum approach.

In our first test from January 2018 to March 2024, we captured the brutal 2018 bear market. The DCA strategy won, with a 668% profit. By gradually accumulating over time, DCA was perfectly positioned to buy Bitcoin at lower prices during the bearish period.

However, the script flipped in our second test spanning January 2019 to March 2024. By entering after the bear market bottom, the lump sum strategy skyrocketed to an eye-popping 1,527% return, leaving DCA’s 427% profit in the dust.

These lump sum gains are impressive. But, it’s crucial to remember: the test period includes over 4 years. During this time, lump-sum investors could have been underwater before realizing any profits.

Reward-Risk Ratio: A Better Measure

Raw returns only tell part of the story. The reward-risk ratio provides a more holistic lens by considering the risk taken to achieve those profits. It’s calculated as:

- Reward-per-Risk Ratio = Dollar Profit / Sum (BTC Held each day * Risk each day)

The Bitcoin risk is a score ranging from 0-100 measuring the market’s pulse. It is calculated by AlphaSquared’s machine learning model that analyzes a universe of market factors.

A higher reward-per-risk ratio means capturing more upside. It also means taking on less risk. This is the ultimate goal for any investor.

In our first test, DCA had a higher reward-risk ratio of 0.76 versus 0.53 for lump sum, indicating better risk-adjusted returns. Surprisingly, in test 2, DCA maintained its edge with a ratio of 0.80 compared to lump sum’s 0.77.

The reason? With lump sum, you hold a large amount of Bitcoin at all times, exposing you to high risk levels during volatile periods. DCA, however, spreads out your holdings over time, reducing overall exposure to elevated risk levels.

Key Takeaways: Lump Sum vs DCA

So while lump sum can supercharge profits with perfect timing, DCA offers a more risk-managed approach. This is especially important during volatile stretches where hasty lump sum entries can be disastrous.

But what if there was a strategy that could dynamically adjust your investment amounts based on quantified market risk? One that captures lump sum upside during bull runs while reducing exposure like DCA when turbulence strikes?

Such an approach does exist – it’s called risk-based DCA, and it represents the perfect middle ground.

Part 3: Risk-adjusted DCA – Overcoming the Limitations

For years, we grappled with the lump sum vs DCA debate like every other crypto investor. we tried both strategies, experiencing their downsides firsthand.

With lump sum, the volatility and emotional burden was overwhelming. DCA provided much-needed psychological relief. But we still bought at highs during frenzied markets and left major profits on the table.

That’s when in early 2021, we came up with a third approach that could provide the best of both worlds – Risk-adjusted DCA. we began using it as a potential middle way, and it has worked extraordinarily well since.

Risk-based DCA: The Best of Lump Sum & DCA

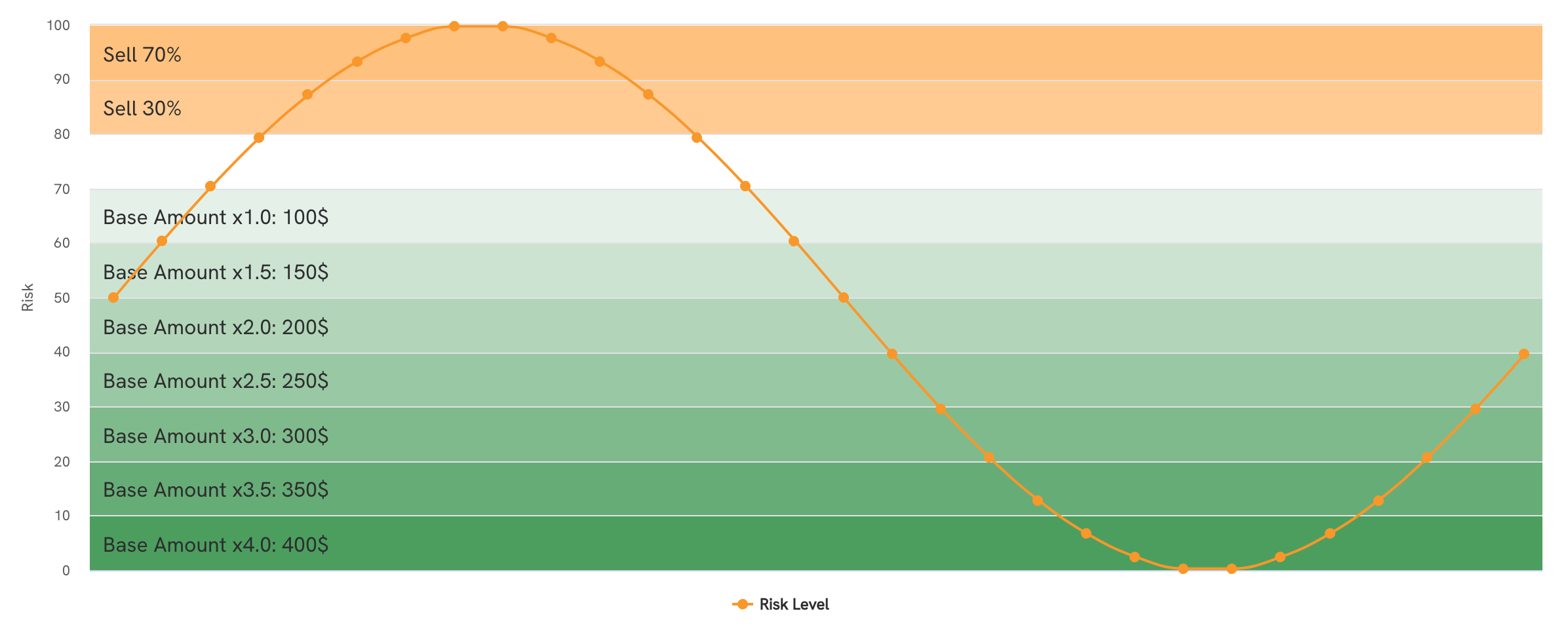

Risk-based DCA is a unique approach that adjusts investment amounts based on quantified market risk:

- The lower the risk, the more you increase your investments. This allows you to get the lowest possible average cost-price.

- The higher the risk, the more profits you take. By selling larger portions the higher risk goes, you always secure some profits. Yet, you still save the majority of your crypto until the risk is high.

Unlike prediction-based strategies, risk-based DCA uses machine learning to classify current market risk instead of guessing the future.

Solving the Problem of Lump-sum and DCA

With risk based DCA, you still DCA as usual. However, you allocate your capital more effectively. You save cash when risk is high, enabling you to invest more when risk and price is lower. This unites the advantage of Lump Sum and DCA into a single, easy-to-use strategy. You can sign up for free here.

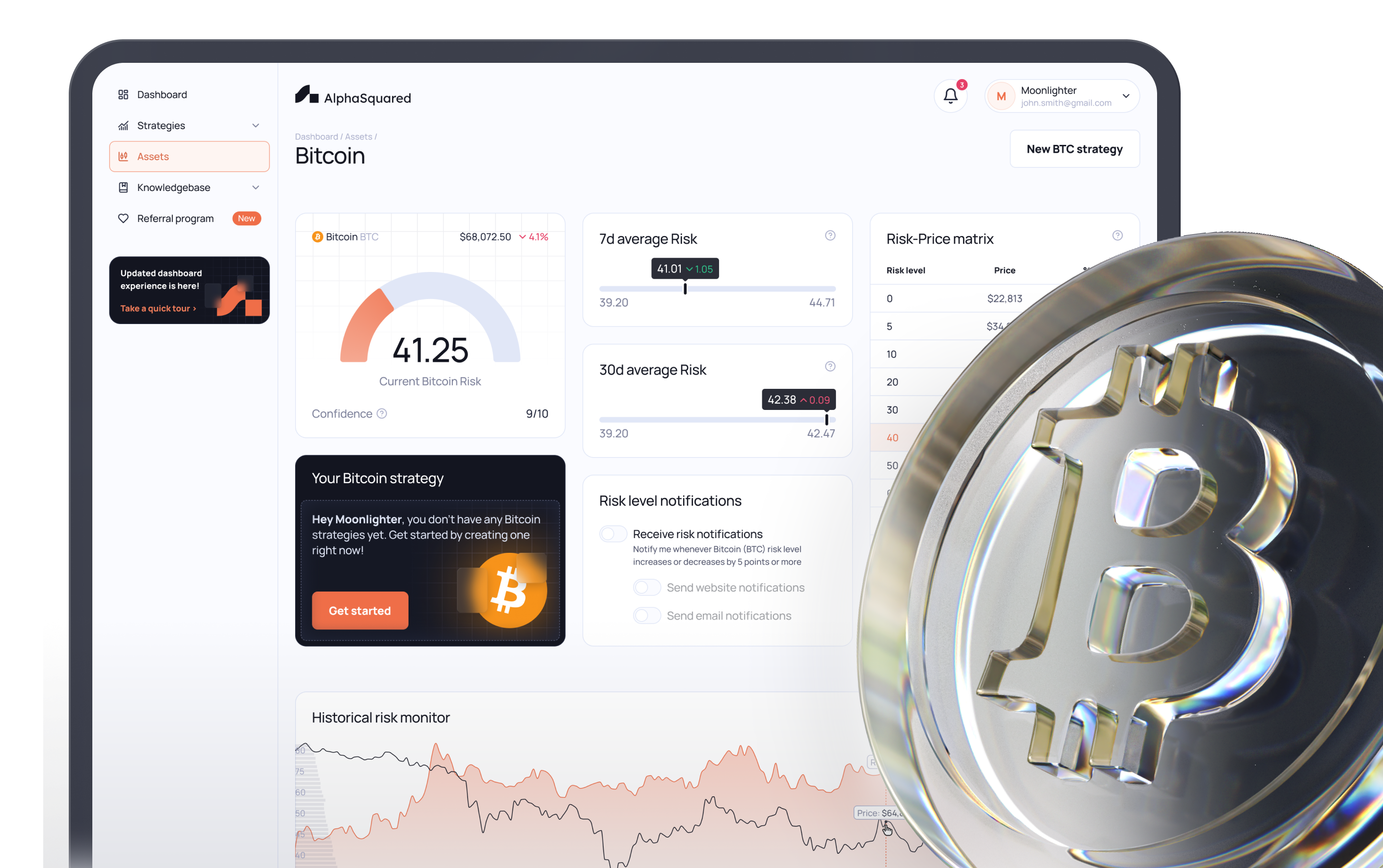

AlphaSquared’s sophisticated machine learning risk model for Bitcoin:

- Analyzes vast market data daily

- Condenses insights into a 0-100 risk metric

Combined with a customizable risk-based DCA strategy, you will:

- Develop and stick to a clear investment strategy. Easily adjust buys/sells based on measured market risk.

- Overcome emotional reactions like FOMO, FUD, and anxiety by relying on a data-driven, risk-based approach.

- Eliminate hesitation about when to invest and take profits by following a firm strategy triggered by risk levels.

No more emotional decisions or haphazard buy/sell calls. Just a systematic, data-driven approach backed by years of positive real-world results (including my own over 2+ years).

Ready to leave the lump sum vs. DCA debate behind? Check out How it Works or try the DCA vs. Risk-Based DCA Calculator.

Conclusion

Both lump sum and regular DCA have pros and cons that depend heavily on market timing, risk tolerance, and personal circumstances. Make sure you examine these thoroughly before making a choice.

A dynamic, risk-based DCA adjusts positions based on quantified market risk. This provides the ideal middle ground if you’re not fully convinced by either strategy.

Regardless of what strategy you choose, make sure you stick to it, and good luck!